【新唐人2011年10月24日訊】中國財政部近日宣佈四個省市做為發行地方政府債券的試點。有專家認為,在中央和地方財政預算、支出不透明,缺乏監管和主體責任不明確的前提下,舊債未還又借新債可能會加劇「地方債」危機。更有網友指出:這個政策就是給了地方政府另外一把搶劫的槍。請看報導。

中國財政部17年來首次允許地方政府自行發債,從另外一面反應了地方財政危機已到白熱化的邊緣。截止到2010年底,中國地方政府債務總額達到10.7萬億元人民幣,佔中國銀行借貸的80%。2011和2012年,地方政府集中償還到期的債務高達4.6萬億元人民幣。

海內外經濟學者認為,中共政府為解決地方債務危機的應急措施,並不能解決實際問題。

英國劍橋大學經濟學者張煒在接受BBC中文網的採訪時表示,中共中央和地方財政沒有理清,同時地方政府的財政也沒有透明,再加上沒有很好的得到立法機構和地方老百姓的監督,這種情況下推行地方債,可能會對中國老百姓產生危險。

英國《金融時報》也提出警告說,中國大陸地方政府的大部分借款無法償還,恐怕給中國金融帶來嚴重破壞。銀監會官員也承認,地方政府融資平臺存在管理不規範、監管機制缺失等重重風險隱患。

而財政部通知,明年四個試點由財政部代辦還本付息,債券的償還還是由中央負責。

經濟學家茅於軾指出,政府信用不良,正是地方發債的風險所在。

茅於軾:「風險就是政府能不能可靠的還債啊,因為中國﹙共﹚政府不是信用很好的一個單位,(風險)也沒法控制,因為政府不能打官司啊,別的企業可以跟他打官司,政府你跟他打官司你打的贏嗎?誰監督政府啊,不像別的國家老百姓監督政府,我們這政府監督老百姓,老百姓不能監督政府的。」

茅於軾認為,中共在短時期內要完成所謂229億元人民幣的發債額度,可能性不大。

經濟學家茅於軾:「所以我估計,這樣一個地方政府債券對普通老百姓沒有多大吸引力。我猜想,他只有一個辦法,就是讓國企去買債券,等於是一種攤派性質。可以拖一拖還債的問題,沒有徹底解決問題。問題還在嘛、後果是出賣國有資產、這是一條路。」

公眾對四省市將啟動自行發債試點消息的也持批評態度,有網友在微博上質問:中國幾大國有銀行不是很有錢嗎?為甚麼不肯貸款給地方政府?因為地方政府從來就沒想過還錢。現在自行發債,只不過是變相為政府捐款而已。

還有網友說:為甚麼不大幅縮減「三公」支出?

知名博主五嶽散人寫道:通俗的說,這個政策就是給了地方政府另外一把搶劫的槍。

新唐人記者張麗娜、許旻、王明宇採訪報導。

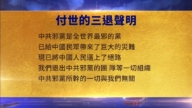

Local Bonds: A Repetitive Robbery Committed by the CCP

Chinese Ministry of Finance recently announced a pilot project.

Four selected provinces will issue local bonds.

Experts criticized that under the premise that

both central and local budgets are not transparent,

lack supervision,and have no clear purpose,

local debt crises will only worsen with new debts.

People also criticized, via the internet, that this pilot study is

just another gun issued to the local government for robbery.

The following is our report.

For the first time in 17 years, the Chinese Ministry of Finance

allowed local governments to issue bonds on their own.

This reflects that local financial crises have fiercely intensified.

Until the end of 2010, the Chinese local government debt

amounted to 10.7 trillion yuan, accounting for 80% of Chinese bank lending.

In 2011 and 2012, the total of due debt to be paid back by

local governments was as high as 4.6 trillion yuan.

Economists both internationally and domestically do not

believe this type of emergency plan will solve any practical

problems the local government is facing financially.

Economist at University of Cambridge, Zhang Wei, told BBC

that the CCP has a messy financial situation existing in both

central and local governments.

The financial system is not transparent and lacks supervision

from both the legislative level and the general public.

Under such a condition, the implementation of local debt

might be dangerous for the Chinese people.

As warned by British Financial Times, Beijing』s emergency

policy might have spurred growth,but simultaneously worsened bad debts.

China Banking Regulatory Commission officials also admitted

heavy risks exist in local financing platforms, such as irregular

management and lack of regulatory mechanisms.

According to the Ministry of Finance, the Treasury will pay

for the debts of the four selected local governments for next year,

and central government will repay the bonds.

Economist Mao Yushi indicated that bad government credit

is exactly the risk of local bonds.

Mao Yushi: " The risk is whether the government is

reliable at paying back the debt, after all Beijing government

does not have a good credit.

(Risk) can』t be controlled, because government can』t be sued.

Who is monitoring the government?

It』s not like other countries where people monitor them.

Here our government monitors the people,

people can』t (monitor) the government."

Mao Yushi does not believe CCP is likely to accomplish raising

a total combined quota of 22.9 billion yuan before the end of the year.

Translator』s note: see relevant article

Economist Mao Yushi : “So I believe such local

government bonds won』t appeal to the general public.

I guess, to have state-owned enterprises buy bonds, that is,

distribute the bonds as the only way is the nature of this project.

Delayed the problem of debt, not solved it completely.

The problem exits. The consequence is to sell state assets,

that is a way out."

Public opinion is also very critical of the CCP』s pilot project.

As seen on the website, people questioned, “Several

state-owned banks are quite wealthy.

Why wouldn』t they lend the money to the local government?

Because local government will never think of paying back.

The local bonds are only a disguise to ask for donation.

There are also people who questioned: Why not substantially

reduce the official expenses?

Well-known blogger Wuyui wrote: Quite frankly, this policy is

to serve the local government for allowing them another gun to commit a robbery.

NTD reporters Zhang Lina, Xu Min and Wang Mingyu