【新唐人2014年04月05日訊】日前,中共國務院宣佈了一個支出方案,包括建設新鐵路和地鐵,建廉租房和小企業減稅。外媒認為,這些措施是在中國經濟放緩的情況下,中共為了維持代表國民生產總值的GDP數字好看,而採取的刺激方案。不過專家們指出,這些措施不但不能解決問題,還可能引發信貸泡沫。

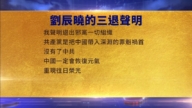

4月2號,中共國務院總理李克強主持召開國務院常務會議,他表示,中共政府推出了驅動今年中國經濟穩增長的三輪子政策,其中包括減輕小微企業稅負,加快棚戶區改造,和加快鐵路建設,尤其是中西部鐵路建設。

美國《華爾街日報》認為,這些措施是因為今年三月中國製造業和地產行業進一步下滑,迫使中共領導人做出的艱難抉擇,報導說,最新推出的經濟刺激措施蘊藏的信息是,經濟增長的重要性大於對信貸泡沫的擔憂。

經濟評論專家馬傑森:「棚戶區改造,無非就是城鎮化過程,有經濟能力搬到城裡的,早已經搬到城裡了,有房地產需求的一、二線城市,棚戶區改造,基本上都已經完成了,邊遠的城市本身現有的房地產都消化不了,基礎產業—鐵路公路已經不是制約中國經濟發展的主要因素了,再投資的話,已經是為了投資而投資了。」

目前,在房地產的瘋狂投資和扭曲發展下,中國已經出現12座鬼城。它們分佈在內蒙古鄂爾多斯附近、和遼寧營口、江蘇常州、湖北十堰、昆明呈貢等三線城市,遍及中國各地。

那麼擴大小微企業所得稅優惠政策,這種看似催生市場內生動力,讓利於民的方案能奏效嗎?

馬傑森:「中小型企業減稅已經喊了很多很多年了,不但沒減,而且負擔越來越嚴重,現在隨著中國經濟的放緩,地方政府一定會受到負面影響,房地產泡沫逐漸的要爆掉,也會使得地方政府的土地財政受到很大的威脅,地方政府這個時候缺錢,它絕對不可能再去砍斷稅收這個財源。」

「北京天則經濟研究所」副所長馮興元曾經對《新唐人》表示,地方政府債務壓力大時,除加強亂收費外,還會要求企業,今年把明年的稅收等費用先交上來。

目前各項數據顯示,中國經濟在放緩。滙豐發佈的3月份中國製造業採購經理指數為48%,創8個月新低。投資增長則創下近6年來新低;而消費品零售總額,創下了2009年以來新低;出口也大大低於去年同期水平;房地產銷售、鐵礦石價格、銅價都出現了大幅下跌;港口鐵礦石、鋼鐵和煤炭庫存則大幅提高;企業違約、地方債務和產能過剩,都使宏觀經濟承受壓力。

北京大學光華管理學院博士生導師王建國:「總體而言,我覺得短期刺激還是必要的,但是解決不了根本問題,根本問題是要放鬆管制,必須把權控市場經濟變成一個自由競爭的市場經濟,經濟問題才可以改變。因為管制和貪腐是一對孿生兄弟,如果你又不放鬆權控,又去反貪,經濟就會死。」

「北京大學光華管理學院」博士生導師王建國教授指出,目前中國面臨兩難,不反腐,民怨太大,而反腐,又使官員們失去動力,當前的反腐使中國的很多行業蕭條。

另外,業界擔心,在貨幣發行已經達到110多萬億元人民幣,超過GDP將近兩倍的大背景下,這次刺激經濟會不會再次依賴貨幣措施。

王建國:「中國目前經濟不活躍,不流通,印出來的票子就變成了死錢,像水變成了冰一樣。再把票子往裡面加,一旦經濟回暖,就會出現經濟泡沫,就會出現金融危機。」

而國務院常務會議提出的「向郵政儲蓄等金融機構籌資,鼓勵商業銀行、社保基金、保險機構等,參與棚區改造及基礎設施工程建設」,這些用來解決棚戶區改造資金短缺問題的方案。《華爾街日報》質疑,最終會導致類似於美國、歐洲的泡沫破裂,製造大衰退。

採訪編輯/劉惠 後製/李智遠

China Trapped In Dilemma To Stimulus Economy

The Chinese Communist Party (CCP) State

Council has announced it‘s program of spending.

This includes the construction of new railways and subways,

building low-cost housing and small business tax cuts.

Foreign media believe that in facing an economic

slowdown, the CCP is adopting stimulus measures.

It is acting in order to maintain a good GDP number.

However, experts point out that these

measures cannot help solve the problem.

They may also lead to a credit bubble.

Narrator:

On April 2, CCP Premier Li Keqiang

hosted a State Council executive meeting.

He said that the CCP government has launched a three

prong policy to drive steady economic growth during 2014.

This includes reducing small business enterprise

taxes, accelerating rebuilding of shantytowns,

and also accelerating railway construction.

These plans will especially effect

central and western railways.

The Wall Street Journal reports that CCP leaders

are being forced to make these tough decisions.

This is because of further declines in the

manufacturing and real estate industry.

The report says the hidden message from these recent

stimulus measures is the importance of economic growth

is greater than concerns over an impending credit bubble.

Ma Jiesen, China economic expert: “The rebuilding of

shantytowns is nothing more than a process of urbanization.

Those who have the economic

ability have moved to the cities.

In those first or second-tier cities, rebuilding

of shantytowns has basically been completed.

In those outlying cities, existing housing cannot be consumed.

As to basic industry; railways and highways are no longer

the main factor which restricts economic growth in China.

If the CCP invests more, it』s only

investing for the sake of investing.”

Currently, under irrational investment and development

of real estate, there have appeared twelve ghost towns.

They exist throughout China, including in Ordos, Inner

Mongolia, Yingkou in Liaoning Province, Changzhou

in Jiangsu Province, and Shiyan in Hubei Province.

So can it work to expand small business enterprise

income tax preferential policies, which seem to stimulate

raw power within the market and benefit the people?

Ma Jiesen: “They have been calling for small

and medium enterprises tax cuts for many years.

However, not only it is not reduced, but also

the situation has become more and more serious.

Now with economic decline, local governments are affected.

If this real estate bubble bursts, local

government revenue will be severely affected.

When the local governments are short of money, they will

definitely not cut another revenue source of SME tax.”

Feng Xingyuan, Vice-Deputy Director of the Beijing

Tianze Economic Analysis Institute commented to NTD.

When local governments have the pressures of

big debts, in addition to strengthening arbitrary

charges, they will also require the enterprises to

hand in their taxes and expenses for the next year.

Currently a variety of data shows that

China』s economy is slowing down.

HSBC released a March China Manufacturing

Purchasing Manager』s index as 48%.

This is the lowest in eight months. Investment

growth reached the lowest in the last six years.

The total retail sales of consumer goods

is the lowest on record since 2009.

Exports are significantly lower

than the level it was a year earlier.

Real estate sales, the price of iron ore

and cooper have all declined sharply.

Iron ore, steel and coal stocks have increased

a lot, and corporate defaults, local debts and

overcapacity all add pressure on macro economy.

Wang Jianguo, tutor, Guanghua School of

Management, Peking University: “Overall,

I think the short-term stimulus is necessary.

However, it cannot solve the fundamental problem.

The fundamental problem is regulation; it

has to turn a controlled market economy

into a market economy with free competition.

As control and corruption sit hand in hand,

if you are neither relaxing control, nor fighting

corruption, the economy cannot survive.”

Wang Jianguo also highlights that

currently China is facing a dilemma.

If they do not implement anti-corruption

initiatives, people will continue to become angry.

If they implement anti-corruption, government officials will

lose power, so many industries now exist under depression.

In addition, professionals worry that, the currency

issue has reached more than 110 million RMB.

This is more than double the GDP, and this economic

stimulus may depend on monetary measures.

Wang Jianguo: “The Chinese economy

is not currently active and circulated.

The printed money has become

dead, like water becoming ice.

If they print more money, once the economy improves,

there will be an economic bubble and financial crisis.”