【新唐人2013年11月15日訊】中共十八屆三中全會閉幕後,上海和深圳股市雙雙下跌約2%,並沒有上演所謂的「慶祝行情」,反而出現七個星期以來的最大跌幅,顯示中國政治、經濟局勢動盪,讓投資者不看好。雖然中國股市在14號弱勢反彈,滬深股指漲幅不大,成交量也沒有放大,市場整體情緒看來是相當謹慎。

中共結束了為期四天的十八屆三中全會閉門會議,這是習、李上臺後第一次最高權力部門的政策宣示。

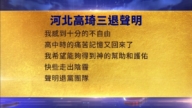

會議宣佈設置由習近平、李克強控制的「國家安全委員會」和「深化改革領導小組」, 強調「完善國家安全體制和國家安全戰略」。

雖然中共媒體在這之前,曾高調炒作涉及司法、國企和土地等敏感議題,但總體改革力度低於預期。三中全會會後的公報也沒有展示改革金融領域和國營企業的決心,沒有實質的政策出臺,在市場欠缺炒作藉口之下,投資者紛紛拋售手中的股票。

美國《華爾街日報》指出,三中全會的改革方案措辭含糊,對改革問題都是點到為止,未達到投資者預期。使得上證綜指13號開低走低,重挫1.83%,失守2,100點關卡,以2,087.94點近全日最低點收盤,也創下近3個月的新低﹔深圳成指與香港恆生指數也分別下滑2.03%與1.91%。

報導引述中國銀盛財富管理首席策略師郭家耀的看法,認為,三中全會沒有為市場帶來好消息,而近期有大批恆指牛證收回區,集結在22400-22600點,進一步加大市場壓力。

《新唐人》特約經濟評論專家馬傑森:「中國的經濟如果不解決現在面臨的問題,是沒有前途的。某一個層面來講,三中全會的不作為就是展現中國未來經濟的不作為,或者是延續老路。所有這些事情,全球看到了,看到了以後,就以一種股票下跌來展現他們對未來的中國經濟沒有信心。」

雖然中國股市在14號稍微的弱勢反彈,但滬深股指漲幅不大。其中比較活躍的股類是安防、軍工和信息安全等,國企改革方面仍然是令人失望的局面,油氣、金融和電力等權重股表現不佳。

根據三中全會的公報,公有制為中國的經濟主體,必須毫不動搖鞏固和發展公有制經濟,堅持公有制主體地位。

大陸經濟學者楊斌:「這些都是套話,這些都是以前的,對吧,但他裡面強調一個國營企業,這個主導地位,控制力和影響力。因為國有企業的效率大家都知道,而且是少數人,國有企業的就業率是非常低的,進去大家都待那麼久,而且都是甚麼人?他要增加國企的活力,本來經濟就已經搞的掉地了,非常讓大家失望。」

英國《路透社》報導說,雖然三中全會政策細節將陸續公布,但全會公報內容模糊,表明中共沒有計劃要大幅減少國家在經濟中的角色。據了解,中共推動改革涉及很多人的既得利益,三中全會上出現激烈的爭吵。

採訪/陳漢 編輯/黃億美 後製/鍾元

Chinese Stocks Stumble on The Closing of The Third Plenum

Following the end of the Third Plenary Session of the Chinese

Communist Party, Shanghai and Shenzhen stock markets

both fell by about 2%, the lowest in the past 7 weeks.

This seems to signal that investors are discouraged by the

politics and economy in China.

On the 14th, the weak rebound and the slow rising of the

Shanghai and Shenzhen stock index indicated

the overall cautious market.

Following the four-day closed-door meeting of the third plenum,

CCP leaders Xi Jinping and Li Keqiang gave their first

statement from the highest power organ.

The communiqué of the Third Plenum declares that the CCP

will set up a central leading team for “comprehensively

deepening reform".

The country will establish a state security committee,

improving systems and strategies to ensure national security.

The previous high-profile hype on the state media regarding

sensitive issues of justice, state-owned enterprises and land

did not make a ripple in the meeting.

The announcement’s lack of determined and substantive

talk on reform in the financial sectors and state-owned

enterprises led the market to stumble from lack of confidence.

Wall Street Journal reported that China shares ended lower

on the 13th after the Third Plenum “offered investors

vaguely worded plans only,

and CCP leaders have failed to address issues

that investors expected to be addressed.

The Shanghai Composite Index dropped 1.83% to 2,087.94

at the close, the lowest in the past 3 months.

The Shenzhen Component Index on the Shenzhen Stock

Exchange fell 2.03%, and Hong Kong’s Hang Seng Index

fell 1.9%.

The WSJ Chinese report quoted China Yinsheng Wealth

Management chief strategist Matthew Kwok who says

he thinks that the Third Plenum has disappointed the market.

A large number of HKex Bull Contracts have been sold at the

strike price of 22,400 to 22,600,

which has further increased the market pressure.

Ma Jiesen, NTD’s economy specialist: “China’s economy

has no hope for its future if it’s problems are not resolved.

To certain extent, the disappointing Third Plenary Session

shows China’s disappointing economic future.

The falling market just represents how the world is showing

their lack of the confidence in the future (of China)."

There was slight rebound on the 14th,

and the Shanghai and Shenzhen stock index rose slightly.

Security, defense, and information stocks were active,

while oil and gas, finance and electricity were poor performers.

The Third Plenum communiqué informs that China will stick

to the dominant role of public ownership, playing the leading

role of the state-owned economy.

Yang Bin, economist: “These are clichés.

But they also emphasize that state-owned enterprises will take

the leading role to control and determine the economy.

We’re all aware of the efficiency of the state-owned enterprises.

The employment rate of state-owned enterprises is very low.

Everyone stays there once they get in, and we know who gets in.

He (Xi Jinping) wants to increase the vitality of state-owned

enterprises.

All of the state-owned enterprises have occupied large assets

in locals. People are surely disappointed."

Reuters reported that while the CCP had issued more details

with the end of the Third Plenum, the report’s lack of detail

“also made clear that it had no plans to radically

reduce the role of the state in the economy."

It is said that “some reforms still face stiff resistance from

powerful interest groups" and “heated debates"

during the closed-door meeting.

Interview/ChanHan Edit/HuangYimei Post-production/ZhongYuan