【新唐人2013年07月22日訊】這些年來,中國經濟的表面繁榮一直是中共用來證明執政合法性的依據。不過隨著「錢荒」的出現,中共統治下的經濟危機,及隨之帶來的中共執政危機,越來越受到外界的關注。日前,日本媒體發表社論指出,中共應該向「不透明的機制」動刀。那麼,甚麼是「不透明的機制」?能不能迴避中國的經濟危機?怎樣才能解決中國面臨的風險?我們一起來看看。

日前,日本《朝日新聞》發表社論指出,2008年,美國「雷曼危機」發生後不久,中共當局就出臺了大規模經濟刺激政策,這項政策因規模巨大、應對快速而受到多方稱讚,但內情卻很糟糕。

當時,接到中央指示的各地方政府,幾乎同時開始大規模投資基礎設施建設和房地產。大部分資金需要依靠地方政府自主籌措,但銀行的正常融資渠道卻有諸多限制。

因此,一些信託公司通過推出高利息金融產品從個人手中籌集資金,國有企業的閒餘資金也紛紛流入金融市場。這種被稱為「影子銀行」的融資方式,顯示「不透明的融資」在不斷膨脹。

文章指出,中國投資、消費需求、出口這「三駕馬車」都出現了動力不足。國際社會關注中國的原因在於,中國的金融體系中或許埋藏著定時炸彈,因此建議向「不透明的機制」動刀。

美國南卡羅萊納大學艾肯商學院教授謝田:「中國這個不透明度機制恰恰是既得利益集團這個專制的機制,中共利益集團已經綁架了中國經濟,從13億中國人民的頭上,用通貨膨脹,房地產泡沫,股市泡沫等方式劫取了大量金錢,而這些幕後的交易,非法的交易因為中國法治的欠缺,非法交易的人士也得不到應有的懲罰。」

國務院參事夏斌撰文指出,中國已存在事實上的經濟危機,目前地方平臺償債缺口、房地產泡沫、過剩產能,三個系統性風險是相互聯繫、互為傳導的。只要某一環節出現較大的事端,風險會瞬間傳導,資產價格即刻大幅縮水,將對全中國城市居民和中產階層形成巨大的威脅。夏斌認為,如果民眾的財富嚴重打折,將會對整個社會、政治的穩定帶來難以想像的衝擊。

台灣大學經濟系教授張清溪:「最嚴重的問題是它的制度問題,這個問題不太會顯示出來,表面上看是金融問題,根本是經濟制度問題,政府介入太多、太深,讓市場經濟不能發揮它的功能,受政府指導的東西就會造成很多後遺症。」

面對中國出現的金融危機等一系列問題,中共高層已經坐立不安。外媒報導,中共總理李克強在一個閉門國務院會議上發了脾氣,當被告知他的上海自由貿易區計劃遭到既得利益集團持續反對時,他氣憤得捶了桌子。

到底要怎樣才能解決中國的經濟問題?

張清溪:「因為它促進內需就是需要使所得分配更平均,但這個東西它做不到,因為它的政治力量介入太深了,很難走回頭路,或者說根本的改變,因為真要改變的話,它可能就解體。不民主化的話,它這些問題解決不了」

隨著「錢荒」的出現,虛假GDP再也掩蓋不住千瘡百孔的中共經濟,看好中國經濟的聲音銷聲匿跡。30年前,跛足的經濟改革帶來的惡果,再一次成為學者專家反思的重點。

中國經濟體制改革研究會特聘研究員毛壽龍:「(改革)這個問題是多方面的,不只是簡單的金融危機,或者是勞動力就業問題,長遠角度來講,可以改變一些理念方面的問題,我們這30年來,是不是發展是最重要的價值﹖是不是其他不發展的價值,或者說和發展比較遠的一些價值,是不是不重要﹖」

近年來,美國經濟學者謝田一直堅持中國經濟將會硬著陸,他的這個觀點,現在得到越來越多經濟學專家的認同。

採訪編輯/劉惠 後製/蕭宇

Japanese Media Offers Advice to Solve the Economic Crisis in China

In recent years, the superficial prosperity of China’s economy

has been used by the Chinese Communist Party (CCP) as proof of its ruling legitimacy.

The appearance of the money hungry mentality,

the economic crisis, along with the party’s ruling crisis, is drawing more and more public attention.

Recently, Japanese media published a commentary article

which suggested the CCP should take action on the “non-transparent system.”

Then, what is the “non-transparent system?”

Is China’s economic crisis avoidable?

What needs to be done to solve the crisis in China?

Recently, Japan’s Asahi Shimbun Newspaper published

a commentary article, saying that

the CCP has made a series of economy stimulating policies

after the “Lehman crisis” in 2008.

The policies were complemented for their large scale

and of fast implementation.

As a matter of fact, those policies haven’t gone well.

At the time being, based on the government’s instruction,

many places began investing in basic facilities and properties across the country.

However, local governments had to be responsible

for the funding.

Meanwhile, there are so many financing restrictions

from banks.

Therefore, some securities companies took the chance

to issue high interest financing products.

Thus, even more money from state-owned enterprises

has also flowed into the financial market in China.

This financing method is called a “shadow banking system,”

which means opaque financing.

The article pointed out that investment, consumption

and exportation, all three economy drivers, currently lack momentum in China.

International communities worry that there might

be a time bomb embedded in China’s financial system

and suggest China take action on this “non-transparent

system.”

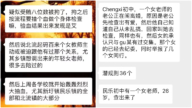

Xie Tian, Professor of Aiken Business School, University

of South Carolina: “Because of the non-transparent system,

the CCP’s various interest groups have already kidnapped

China’s economy.

By means of inflation, real estate bubbles and stock market

bubbles have robbed China’s 1.3 billion people of their money.

Because of flaws in the law, those who trade illegally

and behind the scenes cannot be penalized.”

Xia Bin, Counselor of the State Council, wrote an article

stating that the economic crisis has already come to play in China.

Local government debt, real estate bubbles

and excess capital are intertwined.

As long as something happens to one segment of the chain,

risk will spread instantly to other areas.

Capital will shrink sharply and immediately, which will greatly

threaten the lives of middle class and urban residents.

Xia Bin stated that if people’s wealth is severely discounted,

the impact on the whole society and political stability will be huge.

Zhang Qingxi, Professor OF Economy from Taiwan University,

“It seems like a financial problem on the surface.

Nonetheless, the root cause is the problems in the regime.

The government has intervened with the market too much

and too profoundly, which has caused the loss of market function.

A lot of government central-controlled interference

has caused various after-effects.”

The CCP’s senior authorities are on edge when facing

the series of economic crises.

As reported by overseas media, Li Keqiang lost his temple

in one of the state counseling meetings.

He punched the table when his free market trade problems

in Shanghai was objected to by interest groups over and over.

What on earth should be done to solve

China’s economic problems?

Zhang Qingxi: “If the CCP wants to stimulate domestic

demand, it has to distribute national wealth more evenly among people.

However, since political power has intervened too much,

it would be very hard for it to make a root change because the party would disintegrate.

Without being democratized, those issues

can never be solved.”

With the appearance of the money hungry mentality,

the CCP’s fake GDP numbers are now failing to cover the disastrous state of the economy.

Mao Shoulong, distinguished research fellow

of China’s Economy System Reform Society: “It’s not only

about financial crisis, or unemployment rate.

It involves many aspects, from a long-term perspective,

some ideologies need to be changed.

In the past 30 years, was economic development

the most important value?

Are those other values that are not as relevant to

economic development not important at all?”

In recent years, Professor Xia Tian has firmly stated

that

China’s economy will have a hard-landing (fall into

recession rapidly), which now more and more economists are in agreeance of.